19+ nd paycheck calculator

We use the most recent and accurate information. No personal information is collected.

19 Sample Paycheck Slip Templates In Pdf Ms Word

Calculating your North Dakota state income tax is similar to the steps we listed on our Federal paycheck.

. For example if an employee earns 1500. North Dakota Hourly Paycheck Calculator. Discover a wealth of knowledge to help you tackle payroll HR and benefits and compliance.

So the tax year 2022 will start from July 01 2021 to June 30 2022. The state is notable for its low income tax rates which range. In a few easy steps you can create your own paystubs and have them sent to your email.

The 2022 wage base is 147000. Calculate your North Dakota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Dakota. Step 6 Minus everything.

Overview of North Dakota Taxes. North Dakota levies a progressive state income tax with five brackets based on income level. Simpson diversity index calculator.

Make Your Payroll Effortless and Focus on What really Matters. Area of kite calculator. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Once you have worked out your total tax liability you minus the money you put aside for tax withholdings every year if there is any and any post-tax. COVID-19 Employer Toolkit Diversity Equity and Inclusion Toolkit. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

For the Social Security tax withhold 62 of each employees taxable wages until they hit their wage base for the year. This tool has been available since 2006 and is visited by over 12000. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Payroll pay salary pay check. If you test positive for COVID-19 stay home for at least 5 days and isolate from others in your home. Our paycheck calculator is a free on-line service and is available to everyone.

The state income tax rate in North Dakota is progressive and ranges from 11 to 29 while federal income tax rates range from 10 to 37 depending on your income. Ad Create professional looking paystubs. Back to Payroll Calculator Menu 2013 North Dakota Paycheck Calculator - North Dakota Payroll Calculators - Use as often as you need its free.

How to calculate annual income. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Find The Best Payroll Software To More Effectively Manage Process Employee Payments.

Ad Compare 5 Best Payroll Services Find the Best Rates. It is not a substitute for the. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for North Dakota residents only.

You are likely most infectious during these first 5 days.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Free Paycheck Calculator Hourly Salary Usa Dremployee

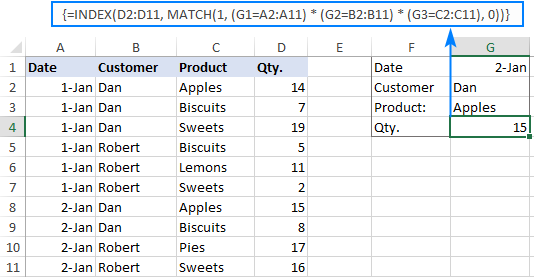

Advanced Vlookup In Excel Multiple Double Nested

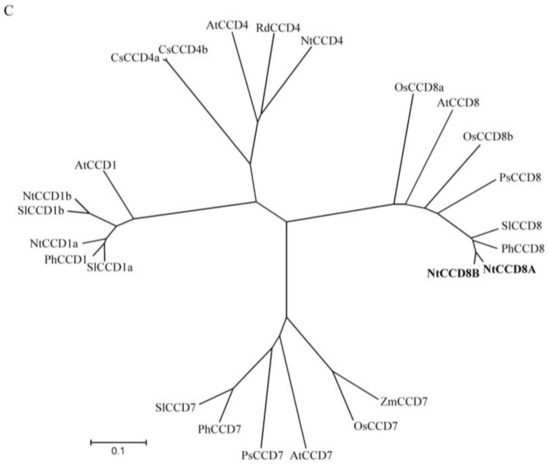

Ijms Free Full Text Crispr Cas9 Mediated Mutagenesis Of Carotenoid Cleavage Dioxygenase 8 Ccd8 In Tobacco Affects Shoot And Root Architecture Html

Paycheck Calculator Take Home Pay Calculator

Lynn Medical

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator And Salary Calculator Employment Laws Com

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

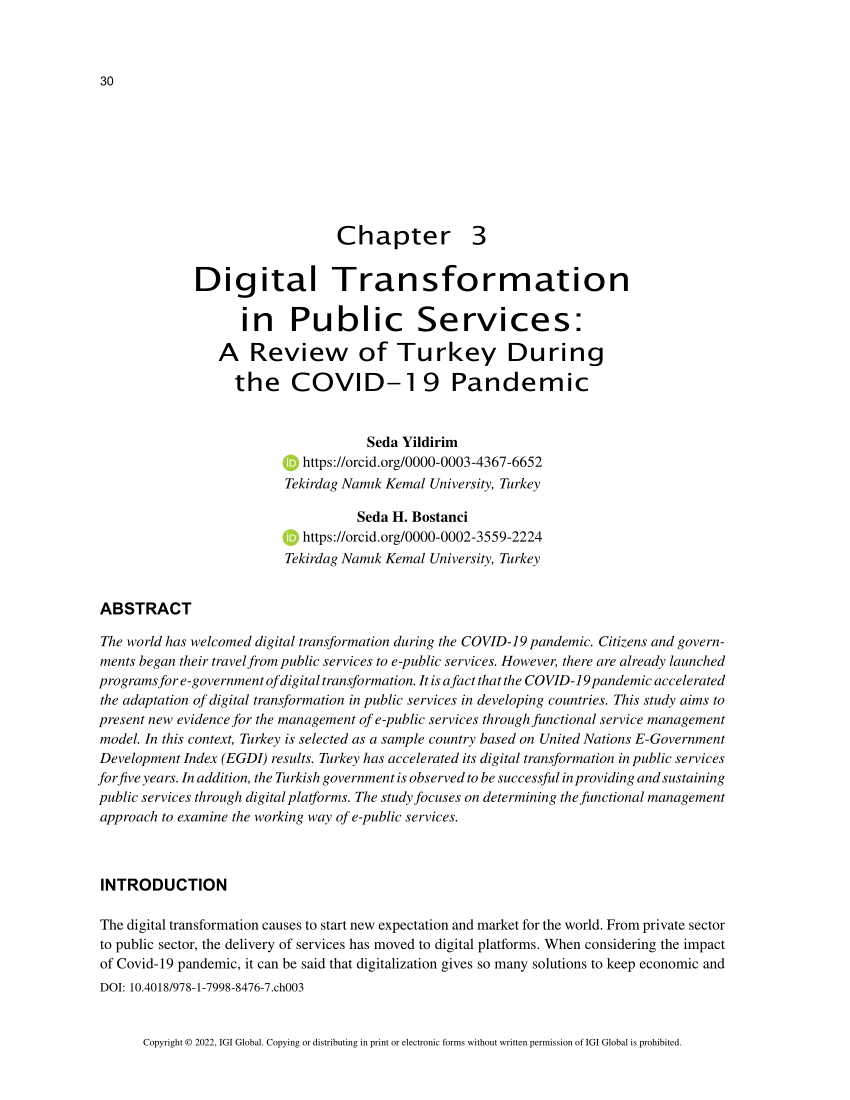

Pdf Digital Transformation In Public Services A Review Of Turkey During The Covid 19 Pandemic

Free Online Paycheck Calculator Calculate Take Home Pay 2022

North Dakota Hourly Paycheck Calculator Gusto

Top 5 Best Salary Calculators 2017 Ranking Top Net Gross Salary Calculators Advisoryhq

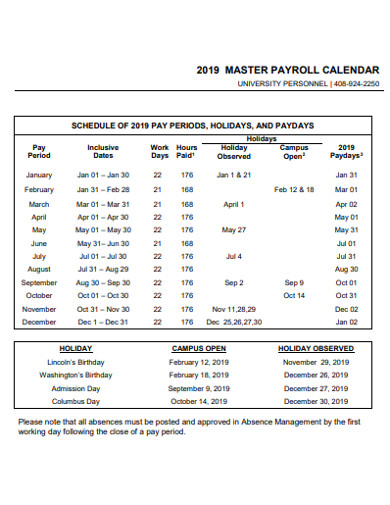

Payroll Calendar 19 Examples Format Pdf Examples

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits